| Risk: how to measure it? |

Once upon a time I played with the monthly returns for various world markets from Jan, 1975 to June, 1997 and found a number of interesting things I'd like to share (connected to the topic of Risk):

Did you know that:

- There was not a single 2-year period when you would have lost money in the U.S. Large Cap market.

- The chances of losing money in European Large Caps was only about 30% of the chance of making more than 10% ... over any 3-year period.

- In Cdn Small Caps, you were 1 1/2 times more likely to make more than 10% annual return over any 12 month period than to make less than 0%.

- In Pacific Large Caps, you would have lost more than 5% of your investment

over a 6-month period 45% as many times as you would have made money.

Consider the following:

There are 246 intervals of length M=24 months (from Jan, 1975 to June, 1997).

You invest in Stock XYZ or perhaps Mutual Fund ABC.

- What fraction of these 246 24-month intervals would have given you an annual return greater than U = 10%? (U stands for Upper.) Suppose the answer is 0.5 meaning 50% these intervals would have given you an annual return greater than U = 10%).

- What fraction of these 246 24-month intervals would have given you an annual return of less than L = 0%? (L stands for Lower.) Suppose the answer is 0.1 meaning 10% of these intervals would have given you an annual return less than L = 0%.

The ratio gR3 = (fraction over 10%)/(fraction under 0%) = 0.5/0.1 = 5 means that you were 5 times more likely to achieve a return of 10% or greater than to make less than 0%.

>You could've just divided 50% by 10% and get 5, right?

Uh ... yes.

>What if gR3 = 2?

Twice as likely to achieve 10% than to lose money.

In fact, for Canadian Large Caps, we have gR3 = 2.0 and for other markets we have the following values of gR3:

Cdn Large Cap 2.0

Cdn Small Cap 1.5

U.S. Large Cap 4.9

U.S. Small Cap 7.6

Euro Large Cap 3.2

Asia Large Cap 1.7

Of course, gR3 depends upon the values of Months, Upper and Lower (as well as the total time interval Jan/75 - Jun/97, of course). We'll call it gR3(M,U,L), so that, since the above list considered the case M = 24 months and more than U = 10% and less than L = 0%, then we're talking about gR3(24,10,0).

From the above list we can see that for US Small Caps, gR3(24,10,0) = 7.6

meaning you were 7.6 times more likely to achieve

10% annual return than to lose money, over any 24 month period!

If you've come this far along, you may be interested to know that:

- gR3(24,0,0) = infinity for the U.S. Large Cap market.

- gR3(36,10,0) = 3.3 in European Large Caps.

- gR3(12,10,0) = 1.5 in Cdn Small Caps.

- gR3(6,0,-5) = 2.2 in Pacific Large Caps.

They are precisely the statements 1, 2, 3 and 4 made earlier.

>Why gR3 ? Why not gR2, like E = m c2 ?

For those gallant few who have made it this far, R3 stands for

Reward Risk Ratio:

|

making LESS than L = 0% is the Risk and

making MORE than U = 10% is the Reward and we consider the Ratio so far, we've got R3 |

>The Market Data, can we trust it? Where'd it come from?

Uh ... the data for the various large/small cap markets was obtained here:

>Where's the pictures? You usually have pictures! I mean ...

Here's one:

We consider all the N-year periods starting each month from Jan, 1928 to Year 2000. Then all

the N-year periods starting in Feb, 1928 then starting in Mar, 1928 etc. etc. and

determine the percentage where the annualized gain exceeded 10% and compare it to the percentage

where the gain was less than 4%. The ratio would be ...

>Don't tell me! It's gR3(360,10,4) ... for 360 months and 10% and 4%, right?

Very good, but 360 would be for 30 years. In general ... well, here's the picture:

>Uh ... does that mean that, over 25 years, 68% of annualized returns

were greater than 10% and ...

And none were less than 4%.

>That makes 25 x 12 = 300 months so gR3(300,10,4) = 68/0 = ... uh ...

Infinite. However, one can judge what the "risk" might be for various asset allocations just by

staring raptly at the chart. For example, here's a similar chart where, instead of just the

S&P 500, we invest in a

4 x 25

portfolio: 25% in each of Large/Small Cap and Large/Small Value and rebalance yearly.

However, if we're lookimg for a single number which (somehow!) describes "risk" ...

Okay, let's think about a variation of the above measure of risk:

Suppose we look at the monthly gains (for some stock or mutual fund) which are greater than some pre-assigned percentage, U (meaning Upper), and those which are less than some pre-assigned percentage, L (meaning Lower).

| | u1, u2, u3 ... uN |

| | l1, l2, l3 ... lM |

Uh ... let's assume we ALWAYS choose L = 0 so the L-set corresponds to NEGATIVE monthly gains - that's the risk, right? We also choose U > 0 so it corresponds to POSITIVE monthly gains. Our goal is to invest so that the U-set is huge and the L-set is microscopic.

It's a battle.Will the u's win?

Will the l's win?GO U-set!!

>Keep going!

Okay. If the U-set were distributed about, say, +5% and the L-set were distributed just under "0" (with l's not too negative, corresponding to small monthly losses), and there were lots of u's and not too many l's, we'd be ecstatic.

|

In particular, if we plot the distribution of monthly gains for the

S&P 500

we get the chart

at the right (for the period Jan, 1970 to Jan, 2000)

which gives the number of monthly gains in each interval.

>Finally! A picture! A picture is worth a thousand - L = 0 or to the right of U = something_positive. |  Fig. 1 |

Fig. 2 |

If we delete that part of the chart we get the chart at the left where, for the sake of

concreteness, we've assumed U = 4% and, of course, L = ... >Concrete? Did you say - Now we throw darts at the chart ... >Darts? Did you say - ... and see if it hits the L-set or the U-set. If it misses either of these, we ignore the dart toss. Then we see what percentage of our dart throws (not counting those which miss everything) result in a GOOD gain, lying in the U-set, compared to those which result in a BAD gain. |

Our conclusion? During the period Jan/70 to Jan/00, you were just slightly more

likely to make a monthly gain more than 4% than you were of losing money.

|

>That's pretty lousy! Of course, but asking for a monthly gain exceeding 4% is rather optimistic. If we ask only that it's greater than 1% (that's about 12% per year), then the ratio is about 2. We were twice as likely to make a monthly gain exceeding 1% than making a negative gain.

>Picture! Picture!

>So I'd be twice as likely to make 12% as losing - |

Fig. 3 |

|

We were talking about a single month here! Any of the 360 months in that thirty year period. Of

course, we could also talk about the 12-month gains or the 24-month gains or ...

>So this ratio depends upon U and L and M ... sounds familiar.

|  Fig. 4 |

Pay attention.

Let's assume that L = 0 so that the L-set corresponds to investment losses. In any case, that's what Fig. 4 illustrates. Oh, and I should mention that the vertical axis, in Fig. 4, doesn't measure the NUMBER of returns but the FRACTION of returns. Earlier, in Fig. 1, if we computed the total Area we'd get the total NUMBER of monthly returns, namely 360 (in the thirty year period). Here, in Fig. 4, the total Area would be "1".

>That's confusing ...

Okay, we just take all the numbers along the vertical axis in Fig. 3 and divide them by 360

and we'll get a fraction and that gives us

Fig. 4 which we've also smoothed out so it's a normal curve.

|

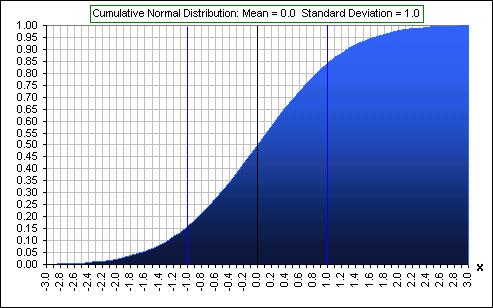

Now, suppose we have a magic formula for the area, from x = a to x = b, under a

normal curve which has Mean = m

and SD = s. We'll call it A(a,b,m,s). Stare at Fig. 5 to see the area we're talking about. Then our Risk Ratio is : A(U,∞,m,s) / A(-∞,0,m, s)

Remember, the TOTAL area under the curve is "1", so

A(-∞,∞,m,s) = 1

>... and the magic formula for the area? |  Fig. 5 |

The Normal distribution (meaning the equation of the normal curve, most of which is shown in Fig. 5) is

We'll call this function f(x,m,s) and the magic formula for the area A(a,b,m,s) is:

Whereas there are tables of areas for normal distributions with Mean = m = 0 and SD = s = 1, there ain't hardly none for arbitrary Mean and SD ... so we transform our function like so:

Set x = m + s t in the

distribution function f(x,m,s)

and get

f(x,m,s) dx

=  f(t,0,1) dt

f(t,0,1) dt

and we've succeeded in transforming to Mean = m = 0

and SD = s = 1.

The limits "a" and "b" also change to (a - m)/s and (b - m)/s. In particular, our Area function becomes:

A

((a - m)/s

,(b - m)/s,0,1 )

A

((a - m)/s

,(b - m)/s,0,1 )

|

>Contracts horizontally? >But 68% isn't 2/3. >Is this measure of risk any good? |  Cumulative Normal Distribution, showing the effect of changing the SD |

- The average gain was 1.3% (so we put Mean = m =.013)

- The Standard Deviation was 6.5% (so we put SD = s = .065).

- We'll select our "reward" as 1% (meaning any monthly gain of 1% or more is a GOOD gain). That puts U = .01, so

- we now compute (as prescribed above) the number

(U - m)/s =

(.01 - .013)/.065 = -0.046

and the number - m/s = -.013/.065 = -0.20 - Now we compute (as prescribed above) the Ratio:

A ((U - m)/s ,∞)) / A (-∞ ,- m/s) = A(-0.046,∞) / A(-∞,-0.20)

>Wait! What's this (1 - 0.48) stuff?

We get, from Fig. 6, that the fraction of values which are less than -.046 is 0.48,

hence the fraction above -.046 is (1 - 0.48). Anyway, we conclude that you were

1.23 times as likely to have a monthly gain greater than 1% than you were to lose money,

in GE stock, over the thirty years 1970 - 2000. That's 23% more often. That's good, isn't it?

>But you already have the data. Is it true? I mean that percentage, 23% ... was it 23%?

Hmmm, good question. Let's see ... I'm looking at the data ... there were 178 months with gains of

1% or more ... and 160 with negative gains ... that gives a Ratio of 178/160 = 1.11 so ...

|

Here's another neat thing. A measure of Risk which goes like so:

See also another Frontier. |

|

In any case, let the gurus use their silly definitions, like "Volatility = Risk". Here's another definition of "Risk": >Is it any good?

Okay, here's the question:

For us mere mortals,

let us not say that the GREEN stock

has been a riskier

investment than the RED:

Let's just say it's been more Volatile.

Over the past umpteen years, investment A has had a Mean return of 10% and a Volatility

of 20%.

Do you believe that? (See

this

for a Monte Carlo-type answer.)

Investment B has had a Mean return of 12% and a Volatility

of 25%.

Investment B has had a higher Volatility ... hence has been more risky.

Now suppose there existed a (fictitious) Mutual Fund which guaranteed a minimum annual return.

The chart looks like so, for the past twenty years.

The Volatility has been greater than the S&P 500 ... so it's riskier.

>Do you believe that?

Several Nobel prize winning physicists DEFINE "Green Cheese" to mean the constituents of the moon.

The headlines read: "The moon is made of Green Cheese!"Ain't definitions wunnerful?

You can turn the moon into green cheese

... and Volatility into Risk

>So what definition of "Risk" do you like?

Me? Personally? I like something like the following:

Assume a percentage, say 30%, of your portfolio is devoted to stocks (and 70% to bonds, with annual rebalancing):

|

(1) Pick, at random, annual stock returns (from, say, S&P 500 data over the past 75 years). (2) Assume that the average annual bond return is 5% with Standard Deviation of 8%. (3) Do a thousand Monte Carlo simulations, assuming a 5% annual withdrawal from this portfolio, this amount increasing at 3% annually, due to inflation. (4) See what percentage (of the thousand simulations) do NOT survive for 30 years: call it X% (5) Change the percentage devoted to the stock & bond components and repeat (1) - (4). (6) Get excited about the percentage that minimizes X%.

|

|

>That's a complicated definition. I mean, what if I'm not even withdrawing

from my portfolio?

That's not relevant. This definition is complicated, yes, but it does reflect the notion that

"risk" is associated with loss and it depends upon many parameters like returns and volatility

and inflation and asset allocation ... and

it generates a number that investors can relate to.

>You think so?

Yes. Don't you?

>I prefer standard deviation. It's depends just upon one thing: standard deviation.

Fine.

and there's

Standard Deviation and Risk

and Risk/Reward Ratios

and there's

Standard Deviation and Risk

and Risk/Reward Ratios